Business Owners: Do you know much your business is worth?

Is Your Business Sellable?

Whether you want to sell it within a year or 20 years, would someone come along and buy your business today? If so, for how much?

Find out your Company's Sellability Score & Receive a free Business Estimate of Value.

It's confidential and designed to help businesses of all kinds at all stages.

Checkout Now:

I agree to Privacy Policy and Terms of Use provided by the company. By providing my phone number, I agree to receive text messages from the business.

You can Be Our Next success story!

Testimonials

Why learning your Sellability Score is The best path to a successful exit

With countless other paths out there, here's why learning your Sellability Score is the best way for you to create a valuable company.

The old way:

Here's what typical business owners normally do...

Prioritize growing revenue

Use proximity as their competitive advantage

Sell lots of things to a few customers

Find themselves in the weeds of all business operations (their company is too dependent on them)

Strive for satisfied customers

Use a transactional business model

Treat their business like a piggy bank

Shares equity too liberally

The New way:

Here's what our successful clients do...

Emphasize growing value

Offer a product or service with a durable competitive advantage

Sell a few things to lots of customers

Build companies that could thrive without them

Strive for customers who will refer and purchase again

Focus on creating recurring revenue streams

Obsess over how their company creates cash

Protects their equity

Our Promise To You

What you will learn: the 3 stages

#1 Strategize

Assess your readiness for exit and clarify your goals

Evaluate the sellability of your business and understand it's current and potential value

Identify areas for potential growth to enhance your business's value

#2 Maximize

Access our proven tools & resources to increase your business’s value

Focus on the eight key drivers that significantly impact company value

Align with your long-term goals and choose the right time to sell

#3 Exit

Partner with experienced M&A advisors who understand your goals and vision

Develop a customized go-to-market strategy for a smooth transition

Achieve the best possible value & terms for a successful and fulfilling exit

Exactly what you Will receive today!

here's Everything you receive when you checkout:

Your Sellability Score Report

It is a system designed to assess how attractive your business might be to potential buyers. This report can be crucial for business owners who are considering selling their business or simply want to understand its current market position and potential value. Moreover, the report not only helps in evaluating the current sellability but also serves as a guide for improving on the 8 key drivers of company value. For business owners not immediately looking to sell, it provides insights that can help in strategic planning and operational improvements, ultimately aligning the business for better future value.

Assesses the sellability of your business, provides current and potential company value

Helps maximize your company's value, identifies areas to focus on

Critical to business exit planning and execution

Plus also get access to 6 special bonuses!

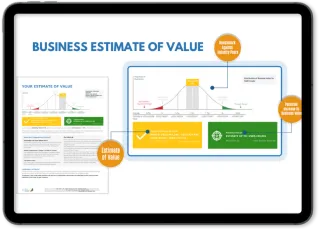

#1 Business Estimate of Value

Our Estimate of Value makes use of discounted cash flow and market comparable methods by comparing industry standard data sources of over 50,000 market transactions along with Rules of Thumb for hundreds of NAICS codes to determine an average market price.

#2 Maximize Your Business Value Course

This course is designed to guide entrepreneurs through the essential factors that significantly enhance business value. Through real-life case studies and strategic insights, you'll gain the knowledge to optimize your company's valuation and attract top dollar offers from potential buyers.

#3 Define Your endgame course & Guide

How do you want to exit your business? Is it selling your company for a large sum or passing the reins to your children and seeing your legacy live on? Or perhaps it’s creating a business that fuels your passion while generating enough income to live your dream life?

#4 Consultation with Drs. Leilani & Fernando

The goal for this online complimentary meeting is to review your Sellability Score Report and Business Estimate of Value and discuss the steps needed to increase your company's value and/or plan your exit strategy. We look forward to meeting you.

#5 Personal Readiness To Exit Score

PREScore™ evaluates a business owner’s readiness to exit their company on a personal level. Using an exclusive algorithm, PREScore™ calculates an owner’s readiness by identifying their status on each of the 4 drivers of a satisfying exit.

#6 Calculate Your Freedom Point

There comes a time when the sale of your company will generate enough income to fund the rest of your life. We call it the Freedom Point. You'll receive your Freedom Score Report, a comprehensive analysis of your financial readiness to enter the next phase of your life.

here's a breakdown of everything you get today.

Get an exclusive look into everything you'll be learning to plan and execute a successful exit.

You get instant access to:

Your Sellability Score Report™ ($4,997 Value)

PLUS ADDITIONAL BONUSES

Business Estimate of Value & Potential Value

Maximize Your Business Value Course

Define Your Endgame Course & Guide

1:1 Online Consultation with Drs. Leilani & Fernando

Personal Readiness To Exit Score (PREScore™)

Calculate Your Freedom Point

Total Price: $4,997

about us

Learn more about your experienced team

Dr. Fernando Acosta & Dr. Leilani Felix-Acosta

Drs. Leilani and Fernando are award-winning Certified M&A Advisors and Licensed Business Brokers, as well as peer-reviewed published authors. Their goal is to help guide their clients define their endgame and making it a reality.

This husband-and-wife duo owns, operates, and leads multiple offices of First Choice Business Brokers (FCBB). They and their agents assist clients in building valuable companies and facilitate the buying or selling of businesses when clients are ready. Their professional backgrounds and shared personal history provide them with a unique level of experience and understanding for their clients. Drs. Leilani and Fernando completed their MBAs and Doctorates together, aiming to continue growing, serving their community, and delivering exceptional service to anyone seeking a career change. This could be through acquiring their first business, expanding an existing one, or planning an exit strategy. Their shared family values, passion for life, culture, and growth enable them to fully comprehend the importance of their clients' success.

Dr. Leilani Felix-Acosta holds a Doctor of Business Administration degree with an emphasis in eCommerce and a Master of Business Administration with a specialization in International Business. Similarly, Dr. Fernando Acosta holds a Doctor of Management degree in Organizational Leadership with a specialization in Information Systems & Technology, a Master of Business Administration with a specialization in Marketing, and a Master of Science in Information Management. Both are Certified Mergers & Acquisitions Professionals and active, contributing members of the International Business Broker Association (IBBA) and Mergers and Acquisition (M&A) Source, where they are innovators in the industry. Additionally, Dr. Fernando is serving as the Vice Chair of the Arizona Business Brokers Association (AZBBA) and is a Certified Business Intermediary (CBI).

Why First Choice Business Brokers?

National Reach, Local Expertise

The World’s Authority in Business Sales

Since we were established in 1994, First Choice Business Brokers has grown to become one of the largest organizations in the U.S. specializing in business sales. We have listed and managed over $12.5 Billion in businesses for sale.

When it comes time to sell your business, we know that you want to be pleased with the outcome. You want to be confident you will get the compensation you deserve. To do that, you need a team of experts who understands business sales, a team who can bring you the correct information and latest market data to assist you in making educated decisions, resulting in a successful exit and maximum value from an endeavor to which you have devoted so many years. Many business owners wake up one day and decide that they need to retire. The knee-jerk decision with little-to-no preparation to sell can result in feeling overwhelmed with conflicting advice, low valuations, and ultimately, an unsuccessful sale of your business. The problem is that you’ve likely never sold a business before. You are unsure of your exit options and are concerned that you will not make the right choices. We understand that selling a business is often an emotional event and can be an overwhelming change in life.

You need a trusted team of advisors to help you. Don’t think of selling your business as a transaction; it’s a significant change in your life that takes a team of experts to help you navigate the process. That's why we built a framework for people who want to sell, that will maximize the value of your business.

Recently Sold Businesses

You Can Be Our Next Success Story!

Frequently asked questions

All your questions answered so you can make the right decision before moving forward!

What exactly is The Sellability Score Report™?

The Sellability Score Report™ is a system designed to assess how attractive your business might be to potential buyers. This assessment can be crucial for business owners who are considering selling their business or simply want to understand its current market position and potential value.

The report is generated based on an online questionnaire that typically takes about 13 minutes to complete. Once filled out, it provides a score out of 100, reflecting the business’s sellability. This score is calculated using an algorithm that considers multiple variables concerning the business's operational, financial, and market conditions. The key factors evaluated include financial performance, growth potential, customer satisfaction, and several others which are critical to potential buyers.

The Sellability Score Report™ includes an in-depth analysis, usually extending to a detailed 26-page document, which outlines your results and elaborates on the eight key drivers of sellability. These drivers encompass aspects such as recurring revenue, customer diversification, competitive advantage (monopoly control), and the strength of the management team among others. Addressing these factors can significantly enhance a company's attractiveness to buyers, potentially commanding a premium price in the market.

Moreover, the report not only helps in evaluating the current sellability and today's business estimate of value but also serves as a guide for improving these key aspects. For business owners not immediately looking to sell, it provides insights that can help in strategic planning and operational improvements, ultimately aligning the business for better future value.

If you're interested, click the link below and you will have instant access to complete the questionnaire to get your personalized report. This tool is especially recommended for those nearing business transition phases or aiming to understand how to enhance their company's market value over time.

do i need to share any financial documents for the business estimate of value? And how is the value determined?

For the Business Estimate of Value, no financial documents will be requested, you will enter estimated high level numbers into our online tool such as top and bottom-line numbers and any add backs. The tool will step you through the process in detail.

How Are Companies Valued?

Discounted Cash Flow Method (DCF): In this method, the acquirer “buys” future income discounted for risk. The discount rate is influenced by internal factors (e.g., dependency on the owner) and external market factors (overall industry stability/growth, interest rates).

Market Comparables (“Comps”) & Rules of Thumb: In this method, the acquirer arrives at a value by comparing a business with companies of a similar size and industry that have sold recently. Rules of thumb have developed over time to provide a close approximation for certain industries.

Liquidation Value: This is usually a worst-case scenario and involves the hypothetical value of the business if it were to be closed and all assets liquidated.

Our Method

Our Estimate of Value makes use of the first two methods by comparing industry standard data sources of over 50,000 market transactions along with Rules of Thumb for hundreds of NAICS codes to determine an average market price. Your Sellability Score is used to measure soft risks and therefore where you will likely land on the range of value typically found among similar businesses in your industry. While we always show an estimate of value, higher-scoring businesses can command strategic prices that may go significantly higher than estimated, while lower scores may indicate that the business is not sellable beyond its liquidation value. While a valuation may sometimes include inventory, usually the business is sold on a debt-free, cash-free basis, meaning the seller would assume any cash or debts as well as non-direct assets (i.e., real estate).

Limitations of Model

The estimate of value in this report is based on information derived from your Sellability Score questionnaire. It assumes the information provided to be accurate and complete. This Estimate of Value is for information purposes only and should not replace a formal Opinion of Value. A business is only worth what someone will pay for it, and therefore the market will ultimately be the most accurate reflection of the value of your company.

If and when you are Ready to go to Market

We will conduct a formal Opinion of Value, we call it Market Price Analysis. At that point we will request financial documents so we can help you maximize the value of your business by recasting your financials, we can discuss those details during our 1:1 consultation.

Who Are Drs. Leilani & Fernando?

Drs. Leilani and Fernando are award-winning Certified M&A Advisors and Licensed Business Brokers, as well as peer-reviewed published authors. They partnered with John Warrillow through The Value Builder System™ in contributing to fulfill his vision of creating one million sellable companies by 2050.

Known as the Broker Doctor Team, this husband-and-wife duo owns, operates, and leads multiple offices of First Choice Business Brokers (FCBB). They and their agents assist clients in building valuable companies and facilitate the buying or selling of businesses when clients are ready. Their professional backgrounds and shared personal history provide them with a unique level of experience and understanding for their clients.

Qualifications

Drs. Leilani and Fernando completed their MBAs and Doctorates together, aiming to continue growing, serving their community, and delivering exceptional service to anyone seeking a career change. This could be through acquiring their first business, expanding an existing one, or planning an exit strategy. Their shared family values, passion for life, culture, and growth enable them to fully comprehend the importance of their clients' success.

Dr. Fernando Acosta holds a Doctor of Management degree in Organizational Leadership with a specialization in Information Systems & Technology, a Master of Business Administration with a specialization in Marketing, and a Master of Science in Information Management. Similarly, Dr. Leilani Felix-Acosta holds a Doctor of Business Administration degree with an emphasis in eCommerce and a Master of Business Administration with a specialization in International Business. Both are Certified Mergers & Acquisitions Professionals and active, contributing members of the International Business Broker Association (IBBA) and Mergers and Acquisition (M&A) Source, where they are innovators in the industry. Additionally, Dr. Fernando is serving as the Vice Chair of the Arizona Business Brokers Association (AZBBA) and is a Certified Business Intermediary (CBI).

Community

The Broker Doctor Team is highly engaged and actively involved in the community. They are members of various organizations, including Arizona Business Brokers Association (AZBBA), Texas Association of Business Brokers (TABB), Arizona Entrepreneurs, KNOW Women, National Society of Leadership and Success, International Honor Society in Business (Delta Mu Delta), the Golden Key International Honour Society, and professional organizations such as the International Business Brokers Association (IBBA) and M&A Source. The team is dedicated to building relationships and positively impacting their community through their involvement and membership in these organizations.

Who is John Warrillow?

John Warrillow is the Founder and CEO of The Value Builder System™, a sales and marketing software for business advisors to find, win and keep their best clients. It combines tools and ready-made content for accountants, brokers, consultants, and financial advisors who focus on helping owners protect, grow and realize the value of their business.

John is the author of the bestselling book, Built to Sell: Creating a Business That Can Thrive Without You, which was recognized by Forbes, Inc., & Fortune magazines as one of the best business books. Built to Sell has been translated into 12 languages. John’s next book, The Automatic Customer: Creating a Subscription Business in Any Industry, was released by Random House in February 2015 and has since been translated into eight languages. In 2021, John released The Art of Selling Your Business: Winning Strategies & Secret Hacks for Exiting on Top. This completes the trilogy of books which teach business owners how to build, accelerate, and harvest the value of their company.

As the host of Built to Sell Radio, John has interviewed hundreds of founders about their exit. Forbes ranked John’s podcast as one of the ten best podcasts for business owners.

Before founding The Value Builder System™, John started and exited four companies. John's vision is to help create 1 million sellable companies by 2050.

Who is First Choice Business Brokers?

Founded in 1994 by Jeff and Linda Nyman, First Choice Business Brokers has grown to become one of the nation’s most trusted business sales specialists. We have listed and managed the sale of over $12.5 billion in businesses. We’re thrilled to bring our decades of experience to business buyers and sellers.

Media Appearances/Features

First Choice Business Brokers has been ranked top 500 in “Entrepreneur's 44th annual Franchise 500” in 2023! We are thrilled to be part of this prestigious list and to celebrate the hard work and success of all the great brands that make up this year's ranking. In recent years, First Choice Business Brokers has been featured in Forbes, Inc., and Yahoo Finance.

Our Mission & Values

First Choice Business Brokers is a team of experienced, licensed professionals who specialize in buying and selling businesses. We understand that the process of buying and selling a business is unique and should not be compared to purchasing or selling a home. We are dedicated to providing our clients with the best selection of businesses and individualized attention. Our goal is to assist entrepreneurs in achieving their desired lifestyle through the buying or selling of businesses. We utilize innovative and creative systems to empower our clients to create and build their future through business. We are a world leader in the business sales industry and are committed to continuing to innovate in this field. We have undergone extensive training, becoming experts in business evaluation, marketing, and negotiations to satisfy buyers and sellers alike.

How does the process work once I Check Out?

Once payment is received, you will instantly have access to The Sellability Score questionnaire, you can fill it out right away or do it later (you will also receive an email with a direct link to the questionnaire in case you want to finish or complete it later).

Step 1: Answer all the questions as best and as honest as you can, the answers will impact the value of your business. You will instantly receive a copy of your Sellability Score Report as an email attachment.

Step 2: Once you get your Sellability Score, you will be asked if you want a Business Estimate of Value, you will have the option to get the estimate of value now or do it later.

Step 3: Once you complete the estimate of value questions you will have the option to schedule a 1:1 session with Drs. Leilani & Fernando to review and discuss strategies based on your Sellability Score Report™ and Business Estimate of Value.

© 2024 First Choice Business Brokers | Each office is independently owned and operated.

FCBB Privacy Policy | VBS Privacy Policy and Terms of Use

NOT FACEBOOK: This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Results cannot be guaranteed and results from individual testimonials are for information only. Your own results and personal experiences may differ to those shown on this site and depend upon a range of factors.